Ever wondered about the huge concrete structures that host shopping malls, MNC offices, hospitals, etc.? Do you know what they are called, their types, or just how they work?

If not, you have landed at the right place. In this blog, we will talk about commercial real estate- what it means, its types, leases, and investment opportunities.

Let’s get started.

Commercial Real Estate Meaning

Commercial space is a property that is used for business operations or income generation.

For business operations, these properties may serve as a space for operating hotels, offices, retail stores, warehouses, shopping malls, medical centers, etc.

For income generation, commercial property owners typically lease the CRE to other people or enterprises. This results in passive income generation through rent, leasing agreements, or other means like parking fees, or advertising revenue.

Another way in which one can generate profits from a CRE property is through capital gains. Capital gains refer to the profits earned on the sale of a property. Know more about Capital gains on the sale of the property.

Now that you know commercial space meaning, you may want to know what are the common differences between a commercial property and a residential property. Let’s know more about this in the section below.

Commercial Property Vs Residential Property: What is the Difference?

| Category | Commercial Property | Residential Property |

|---|---|---|

| Used for | These are used for business operations or income generation (via capital gains or rental income) | These are apartments and standalone homes that are used for the primary purpose of residing |

| Process of Buying | Buying a CRE is a lengthy process as it’s a huge property and hence there are many formalities | The process of buying a residential property is comparatively easier |

| Lease Period | CREs are leased to tenants for a long period of time. These leases may range from 3-9 years or more, as businesses rarely want to shift their operations from one place to another in a short span | Residential properties are leased for a shorter span of time, as here individuals/families may want to shift to another place within as less as 6 months due to a variety of reasons |

| Lease/Rent Contract | CRE lease/rent contracts are in-depth and complex, as they are created for a long tenure | Residential property lease/rent contracts are comparatively simpler as they are created for short tenures |

| Rental Yield | Rental yield for a CRE may range from 8-11% of the capital invested | Rental yield for residential property may range from 1.5-3.5% of the capital invested |

| Stability of Income | Due to the longer lease period, they generate regular rental income for owners for a long time period | As tenants shift to another place in short intervals, rental income for owners is less stable |

| Loan for Buying Property | A loan for buying a commercial property can be given to an individual or a business | A loan for buying a residential property can only be given to an individual |

| Process of Leasing | The tenant and owner both are involved equally in the process of leasing | Residential legislation supports tenants over the owners, hence it is tough to evict the tenants |

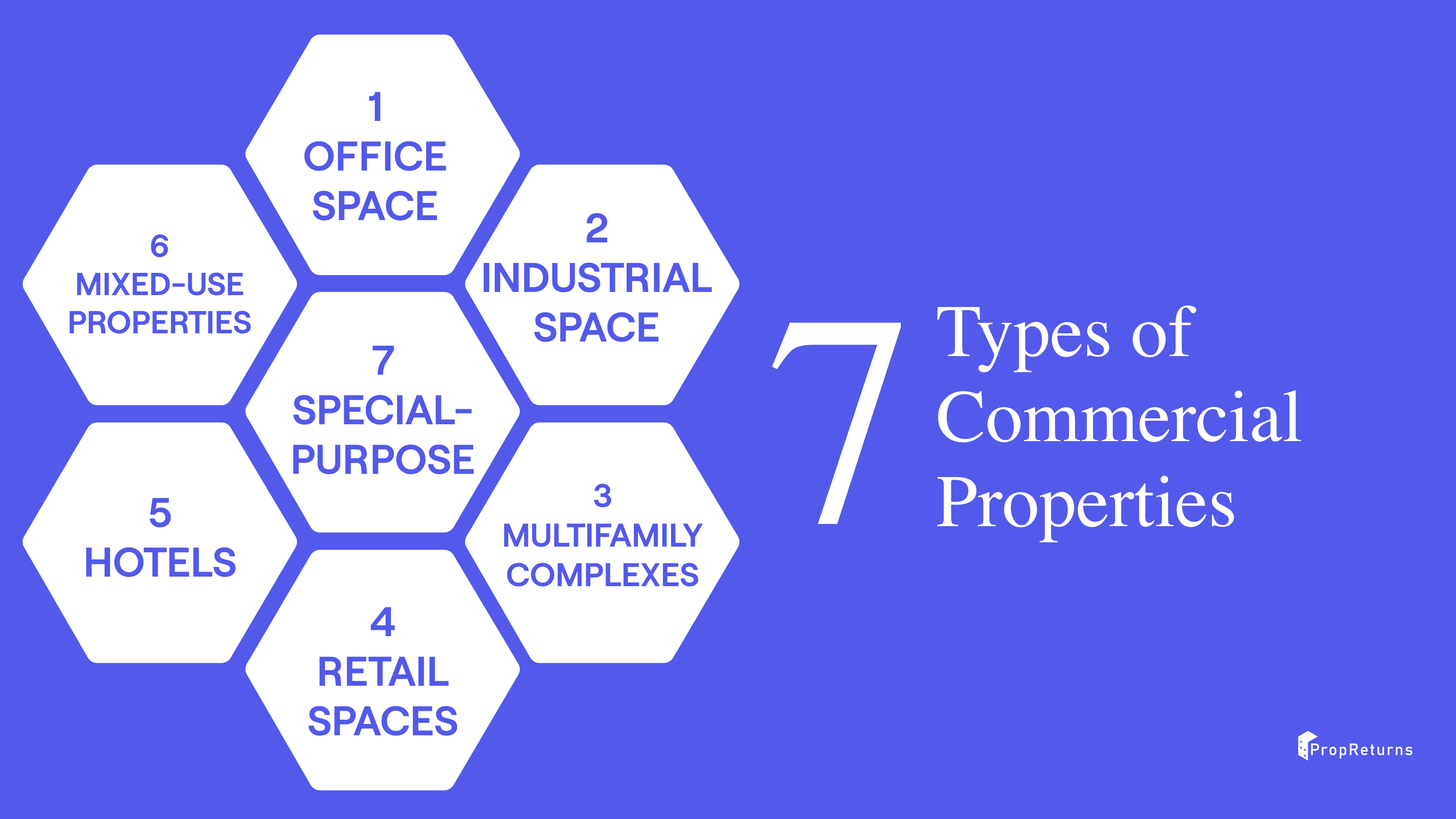

What are the Different Types of Commercial Property

There are 7 different types of commercial properties:

1. Office space

This CRE space is used to set up offices for multinational corporations, call centers, co-working, start-ups, etc.

Office spaces in urban areas are usually skyscrapers and high-rise structures, which sometimes may be as large as a few million square feet. Most of the suburban office buildings are lower in size and occasionally found in office parks.

Some office spaces are built-to-suit. A commercial property tenant enters into a Build to Suit (BTS) agreement with a developer or landowner when the latter builds a brand-new, specially designed facility for leasing.

Based on the number of tenants, office buildings can be categorized into two types:

- Multi-tenanted

- Single-tenanted

Further, there are three classes of commercial office spaces:

- Class A office space

These are prestigious buildings with rents higher than the typical for the area. Class A office buildings have modern technology, excellent accessibility, and a distinct market presence. They also offer high-quality services

- Class B office space

Class B office buildings have rents in the range of the area’s average and compete for a wide range of users. Here, building finishes range from fair to good and the systems are competent

- Class C office space

Office buildings in the class C category are in competition for tenants looking for functional space for rental amounts below the area’s average. One specialized sub-sector in this market is medical office buildings.

To dive deeper into office space classes, click here.

2. Industrial space

Businesses that need vast workshops and assembly lines for their operations— typically in steel, automotive, and other industries—look for industrial spaces.

A majority of industrial buildings are found outside of residential areas, where they contain industrial operations for a variety of tenants.

There are four categories of industrial commercial properties:

Heavy manufacturing: These highly tailored structures house the equipment that manufacturers need to run and develop goods and services Light assembly: They are less personalized and can be used to assemble products or store them Bulk warehouse: These buildings serve as distribution hubs and are typically large Flex industrial: These are a mix of office and industrial space

3. Multifamily complexes

Multi-family complexes are properties that offer housing to multiple families or individuals within a single structure on a rental basis. This type of residential real estate includes apartments, condos, co-ops, and townhomes.

Like commercial office properties, multi-family properties are typically classified into different categories based on their quality and amenities - Class A, Class B, and Class C. These are considered commercial spaces since they generate rental income for the property owner or management company. These properties can be located in urban or suburban areas.

Multi-family properties are further categorized based on their location and size. Garden-style apartments are typically less than four stories high, mid-rise buildings are between five and seven stories, and high-rise buildings are seven or more stories high.

4. Retail spaces

Any property utilized for selling goods or services to clients is referred to as a ‘retail space’. These can include everything from small one-storefront shops to large shopping centers and entertainment hubs. Since it is often located in busy regions, retail space is more expensive than office space.

Long-term contracts in retail are common, and they frequently contain anchor tenants—bigger, more recognizable companies that bring customers to the location. Other tenants in the same facility may benefit from the increased foot traffic.

5. Hotels

Hotels are classified into different categories based on their amenities and services:

Full-service hotels are large hotels with many services including room service, on-site eateries or bars, spas, or fitness centers

Limited-service Hotels are more reasonably priced while being smaller and providing lesser services as compared to full-service hotels

Boutique hotels are singular, full-service lodgings without a big-chain affiliation that are frequently found in urban or vacation areas

Casino hotels are common places to gamble and offer gaming alternatives

Extended-stay hotels are built for longer visits and offer fully functional kitchens

Resort hotels offer comprehensive services and are situated in resort areas that typically have golf courses, water parks, or amusement centers nearby

6. Mixed-use properties

Mixed-use buildings are common in cities. They have business or residential space in the upper area of the building and smaller retail or eatery spaces at the bottom.

7. Special-purpose

Special-purpose real estate refers to commercial properties that do not fall under the traditional sectors of commercial real estate. These properties include amusement parks, theatres, zoos, parking lots, and other unique facilities that serve a specific purpose.

Special-purpose properties can be owned by commercial real estate investors and can generate income through various means.

3 types of Commercial Leases

Leasing out commercial properties is a great way of earning passive income for commercial real estate owners. The type of lease that a tenant agrees to may vary depending on the operational costs covered by the base rental amount and the costs that the tenant has to pay separately.

Here are 3 types of commercial leases in the CRE market:

Gross Lease or Full-Service Lease

A full-service gross lease is a type of commercial lease that includes base rent and operating expenses like utilities and janitorial services. The landlord covers the cost of property taxes, insurance, and maintenance using the rental income. However, ancillary expenses such as phone services and parking are paid for by the tenant.

This type of lease offers convenience and long-term budgeting for the tenant, allowing them to focus on their business rather than worrying about property upkeep. It's a popular choice for multi-tenant office buildings where utility usage is comparable among tenants.

Modified Gross Lease

A modified gross lease bears resemblance to a gross lease, with a few exceptions. While the tenant pays the rent as a single amount, there is room for negotiation between the parties. The involved parties can discuss the expenses that can be incorporated into the base rental rate. Here, certain costs such as janitorial services and electricity are excluded.

As it is more favorable towards the tenant, a modified gross lease is favored by the tenant community.

Net Lease

A net lease is a commercial real estate lease where the tenant pays for the occupied space and some or all usual costs, such as property taxes, insurance, property management fees, or utilities.

There are three types of net leases:

- Single net lease: tenant pays rent and a portion of property taxes

- Double net lease: tenant pays rent, property taxes, and insurance

- Triple net lease: tenant pays for all expenses

- Net leases offer cost control but require the tenant to have funds to cover unexpected expenses, which may increase the risk of going over budget

How can you Invest in Commercial Real Estate?

Recently, commercial real estate investments are gaining traction. This is due to 4 reasons:

- Potential for high returns

- Diversification for investor portfolio

- Regular passive income in the form of the rental amount

- Serves as a hedge against inflation

But, how can one start investing in CRE? Here are some ways that will help you get started:

Direct investment: You may buy a commercial property individually or as part of a group, manage the property

Real Estate Investment Trusts (REITs): You may buy shares of a company that owns commercial properties, trade on stock exchanges, and earn income through dividends

Real Estate Crowdfunding: You may pool money together with other investors, browse projects, invest in a property or portfolio, and access commercial real estate with smaller amounts of capital

Private Equity Funds: You may pool capital from high-net-worth individuals or institutional investors, invest in larger commercial real estate projects, and have a minimum investment requirement

Before investing, research, consult with a financial advisor, and understand potential risks and rewards.

Commercial Real Estate Investment Platform

PropReturns is a platform for users to invest in commercial property in India, backed by data. With us you can build wealth and earn passive income by investing in hand-picked investment Real Estate.

PropReturns offers an end to end solution for investors from placing an instant offer on a high ROI investment property to conducting the entire deal closure flow and paperwork through our platform.

View inaccessible financial metrics for Real Estate, now at your fingertips and save months of research!