In India, out of the total working population almost half comprises millennials ageing from 25 to 40. Millennials are mostly considered to be inclined towards short term rather than having a long term investment plan on paying on EMI for a decade or so. COVID supposedly has created a change in pattern or common practice among the millennials who were more towards renting a house then buying a new one. This change in mind-set could be the result of many factors, such as coming to the age of responsibility and also being a provider of family, working scenario of work from home started to take shape and also control towards reckless spending of the age group due continuous staying at home for more than a year.

There is also a boost in demand for property because the interest rates have been low during the current period and also maintaining a low rate of interest for quite a while has given the investor the drive towards making the investment. Ready-to-move in spaces have come more in demand in recent years by the investors as they do not want to delay acquiring and possessing the property, moreover it is a safer investment option. This type of investment enables setting global benchmarks in real estate for its customers. Due to the fact of ever-changing preferences of the customer to easily transact into a new place. Customer based supply will define the sector by mixing trends with their preferences.

Additionally, they are a well-informed consumer base and also with the effect of globalization the real estate developers in India have also adapted to the new challenges faced in the current market. With the help of technology, the developers have been able to transform their local business into a more efficient and professionally managed business. There has also been a rise of FDI in the Indian real estate market due to increase in transparency, due diligence standards, management methods by the developers. This in result has created efficiency in the market in meeting the need of managing multiple projects and organized the market supply & demand.

Millennials are the new investors in the market which are changing the dynamic of the way of investing in the market. They are well versed in maintaining the traditional methods of investment and also adaptive to technology than their previous generation. Real estate market is also pacing towards providing as per the requirements of the new age consumers but it lacks proper standardization of a proper ecosystem in the market. In a few years, it could all be synchronized with the help of technology and also some measures have started to improve with the introduction of a system in real estate such as REITS in India.

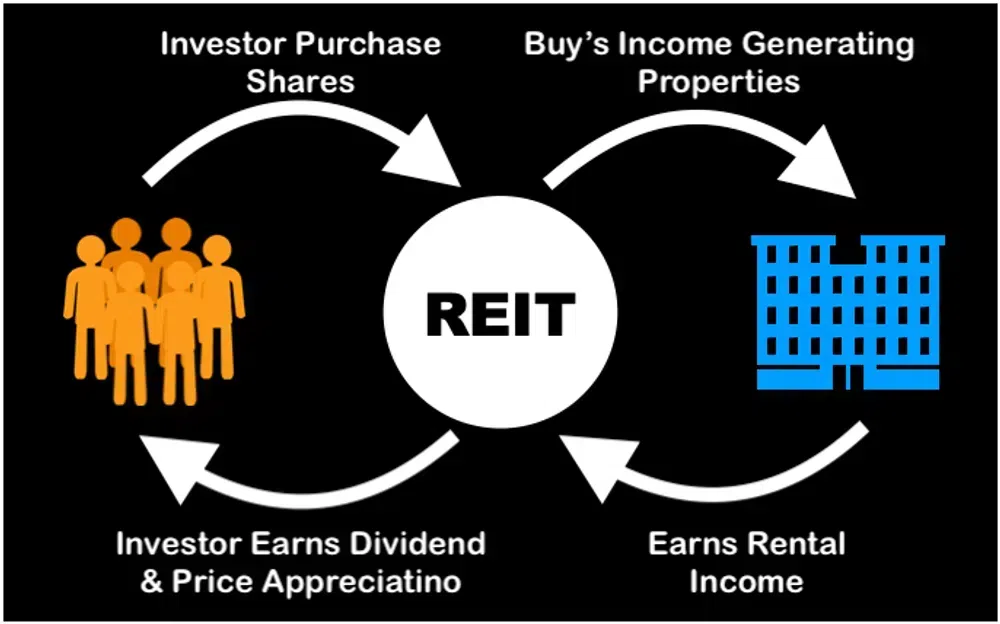

What are REITS?

A real estate investment trust is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and commercial forests.

As a result of all these developments in real estate investment market investing has become easier than ever before. The hassle free nature and exponential returns in the real estate sector is making it a lucrative prospect for budding young entrepreneurs, influencers and well-established professionals.