Capital Gains on Sale of Property in India in 2023

The year 2023 has seen a surge in the Indian real estate market, with property prices soaring to new heights. As more and more individuals look to sell their properties for a tidy profit, it is important to understand the implications of capital gains tax on the sale of property in India.

Capital gains tax is levied on the profit earned from the sale of a property, and it is an important aspect to consider when selling property in India.

In this article, we will delve into the details of capital gains tax on the sale of property in India in 2023 and know the best capital gain tax on the sale of property in India calculator.

What are Capital Gains on Sale of Property?

Capital gains on the sale of property refers to the profit earned from selling a property. The capital gain is the difference between the sale price and the cost of the property.

When you sell a property for more than you paid for it, you have a capital gain, and you may owe taxes on that gain.

Let's say you bought a property in India for Rs. 50 lakh in 2010 and sold it in 2023 for Rs. 1 crore. The capital gain would be the difference between the selling price and the cost of acquisition, which is Rs. 50 lakh (i.e., Rs. 1 crore - Rs. 50 lakhs).

Capital Gain Tax Terms You Need To Know

Full value of consideration: This is the sale price of the asset or the amount of money received by the seller for the sale of the asset.

Cost of acquisition: This refers to the amount paid by the seller to acquire the asset. It includes the purchase price of the asset, along with any incidental expenses such as legal fees, stamp duty, and registration charges.

Cost of improvement: Any expenses incurred by the seller in improving the asset, such as renovation or repair costs, are included in the cost of the improvement. Regulations on Short-Term Gains and Long-Term Gains Taxation Section 80C of the income tax states that the STCG would attract a tax at the rate of 15% if the investor decides to sell it within a year.LTCG would attract a 20% tax rate except on the sale of equity-oriented funds or shares.

Types of Capital Gains on Property

Long Term: In India, long-term capital gains on property refer to the profit earned from selling a property that has been held for more than 2 years. The LTCG tax rate on the property is currently 20% with indexation benefits.

The calculation of long-term capital gains on the sale of property in India involves the following steps:

Step 1: Calculate Indexed Cost of Acquisition Indexed cost of acquisition = Cost of acquisition x (CII for the year of sale / CII for the year of acquisition)

Step 2: Calculate Indexed Cost of Improvement

Indexed cost of improvement = Cost of improvement x (CII for the year of sale / CII for the year of improvement)

Note: The cost inflation index (CII) is a measure of inflation notified by the Indian government each year, and it is used to adjust the cost of acquisition and improvement of the property for inflation.

Step 3: Calculate Long-term Capital Gains

Long-term capital gains = Full value of consideration - Indexed cost of acquisition - Indexed cost of improvement (if any)

The long-term capital gains are taxed at 20% with indexation benefits. The tax liability can be calculated by multiplying the long-term capital gains by the tax rate of 20%.

2) Short Term: Short-term capital gains refer to the profit or gain that an individual earns from the sale of an asset that has been held for a short period, typically less than or up to 2 years.

Short-term capital gains = Full value of consideration - (Cost of acquisition + Cost of improvement)

Short-term capital gains on property are added to the individual's total income and taxed at the applicable slab rates. The tax rates for short-term capital gains can range from 5% to 30%.

If you want, you can also use capital gain tax on the ‘sale of property in India’ calculator. How Cost Inflation Indexation affects capital gains

How Cost Inflation Indexation affects capital gains

Cost Inflation Indexation is a method used to adjust the cost of acquisition and cost of improvement of a capital asset for inflation. This method helps to reduce the tax liability on capital gains by accounting for the effects of inflation on the cost of acquisition or improvement of the asset.

Capital gain tax on the sale of the property refers to the tax that is levied on the profit earned by an individual or entity when they sell a property. The tax liability on capital gains depends on whether the property is sold after a short-term or a long-term holding period. LTCG would attract a 20% tax rate except on the sale of equity-oriented funds or shares.

How to Calculate Capital Gain Tax on Property?

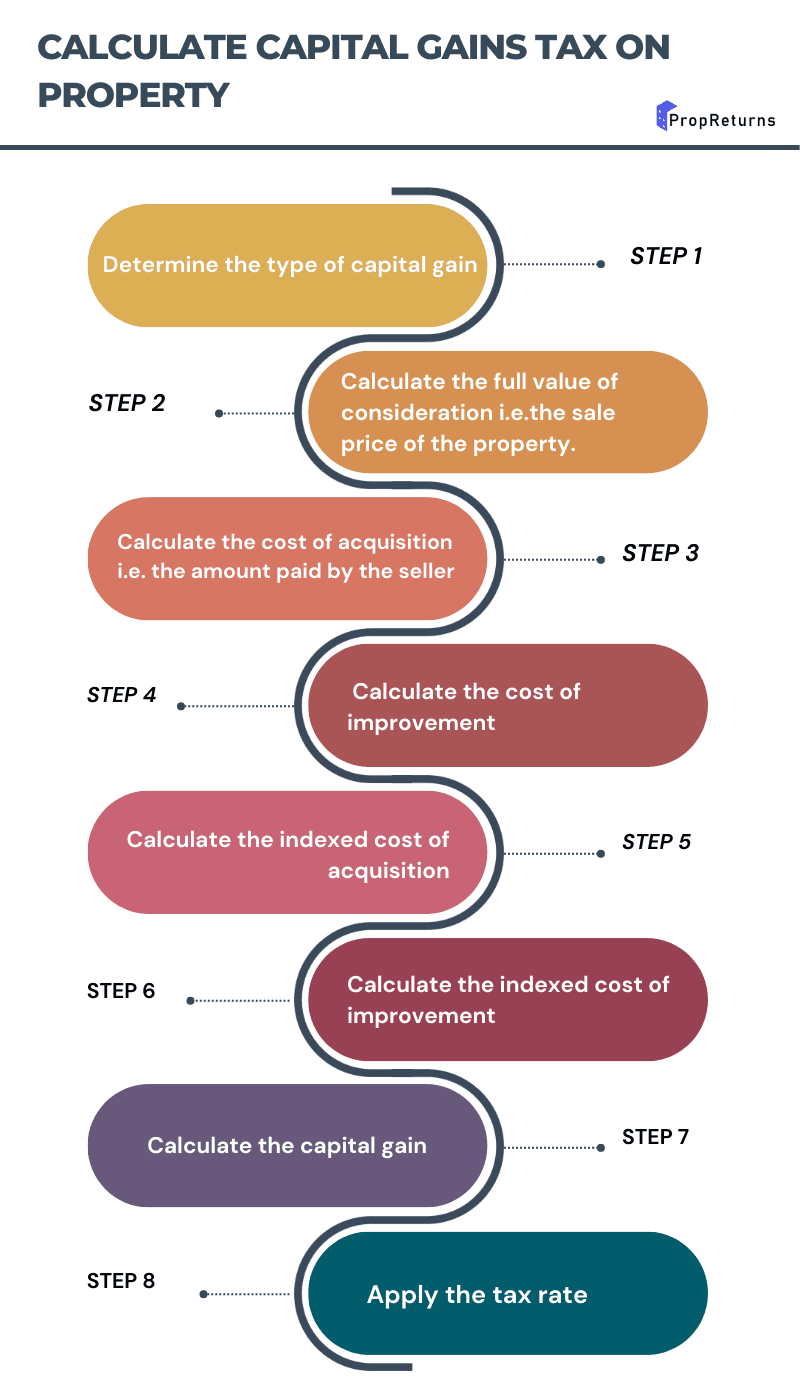

To know how to calculate LTCG/STCG on the sale of property, you need to follow the steps given below:

Step 1: Determine the type of capital gain

The first step is to determine whether the capital gain is short-term or long-term.

Step 2: Calculate the full value of consideration

The full value of consideration is the sale price of the property.

Step 3: Calculate the cost of acquisition

The cost of acquisition is the amount paid by the seller to acquire the property.

Step 4: Calculate the cost of improvement

Step 5: Calculate the indexed cost of acquisition

Step 6: Calculate the indexed cost of improvement (if any)

The indexed cost of acquisition and improvement can be calculated as mentioned above.

Step 7: Calculate the capital gain

Step 8: Apply the tax rate

You can also use a capital gain calculator for AY 2022-23.

How To Save Capital Gains Tax On Property In India

Here are some ways to save capital gains tax on property in India:

Invest in a Residential/Commercial Property: You can save capital gains tax by investing the capital gains amount in a residential property. The new property must be purchased within 2 years of selling the old property or constructed within 3 years.

Invest in a Small Business: Another way to save capital gains tax is by investing the capital gains amount in a small business. The investment must be made within 6 months of selling the old property, and the business must be maintained for at least 3 years.

Use the Capital Gains Exemption: Sections 54 and 54F of the Income Tax Act provides an exemption for capital gains tax if the proceeds from the sale of the property are invested in a residential or commercial property within a specified period.

Conclusion

Understanding capital gains, be it short term capital gains or long term capital gains, can help you make better investing decisions. If you are looking to reinvest money from the sale of property, you can consider the wide range of real estate assets that we have on sale at PropReturns. From top-notch commercial property to the best fractional real estate in India, we have a wide offering that can help you reinvest your money better.