If you are a property buyer, seller, or investor in Maharashtra, you must have heard about the term Ready Reckoner Rate. It is an important aspect that affects the real estate market in the state. The Maharashtra Government revises these rates annually and publishes them on its website. However, not many people understand what it means or how it works.

In this article, we will explain everything you need to know about Ready Reckoner Rate in Maharashtra, including how to check it and its significance in the real estate market. You will also find the ready reckoner rates in Mumbai and Pune regions along with the current premium charge rates in the Mumbai regions.

What is Ready Reckoner Rate?

Ready Reckoner Rate, also known as circle rate or guidance value, is the minimum rate at which a property can be sold or transferred in a particular area or zone. It is a benchmark for property transactions in the state. The government sets these rates based on various factors such as property location, infrastructure, and amenities available in the area. The Ready Reckoner Rate varies from region to region and is revised annually by the state government.

The Maharashtra Stamp Act, 1958, defines the Ready Reckoner Rate meaning as ‘the rates of immovable property for the purposes of payment of stamp duty and registration fees.’ These rates are used to calculate the stamp duty and registration fees that a property buyer has to pay while registering the property. Therefore, it is essential to know the current Ready Reckoner Rate of a property before buying or selling it.

Further, while the Ready Reckoner Rate is primarily used for stamp duty and registration purposes, it also serves as an indicator of the real estate market in Maharashtra. This means that, the changes in the Ready Reckoner Rates can indicate changes in the demand and supply of properties in a particular area.

Importance of Ready Reckoner Rate

The Ready Reckoner Rate plays a crucial role in the real estate market of Maharashtra. The updated Ready Reckoner Rates Maharashtra Government website also provides detailed information on the real estate market. It acts as a reference point for property buyers, sellers, and investors in determining the fair market value of a property. If the sale or purchase price of a property is less than the Ready Reckoner Rate, the government assumes that the transaction is under-reported, and it could attract a penalty or additional tax liability.

As discussed above, the Ready Reckoner Rate also affects the stamp duty and registration fees charged by the government. The higher the Ready Reckoner Rate, the higher the stamp duty and registration fees. Hence, it is essential to keep an eye on the changes in the Ready Reckoner Rate, as it can impact the cost of the property transaction.

How to Calculate Ready Reckoner Rate in Maharashtra?

The Ready Reckoner Rate is calculated based on various factors such as the location of the property, infrastructure, connectivity, amenities, and demand in the area. The government appoints a committee to determine the Ready Reckoner Rate every year. The committee takes into account the market value of the property in the area, along with other factors, to arrive at the rate.

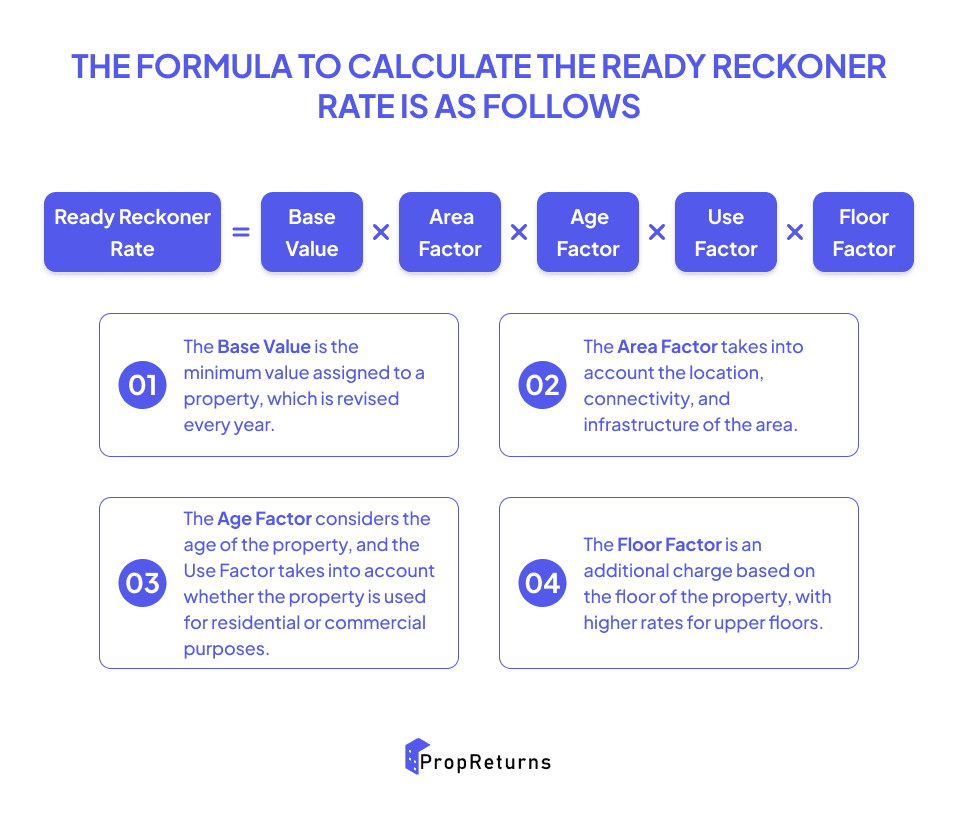

The formula to calculate the Ready Reckoner Rate is as follows:

Ready Reckoner Rate = Base Value x Area Factor x Age Factor x Use Factor x Floor Factor

The Base Value is the minimum value assigned to a property, which is revised every year.

The Area Factor takes into account the location, connectivity, and infrastructure of the area.

The Age Factor considers the age of the property, and the Use Factor takes into account whether the property is used for residential or commercial purposes.

The Floor Factor is an additional charge based on the floor of the property, with higher rates for upper floors.

Example for Understanding Ready Reckoner Meaning in Maharashtra

For example, if you own a property of 100 square meters in the Thane region, the Ready Reckoner Rate (RR Rate) applicable would be Rs 83,800 per square meter, making the RR Rate for your property approximately Rs 84 lakhs. The stamp duty to be paid on your property would be 6% of Rs 84 lakhs, which comes to Rs 5.04 lakhs.

Govt. Ready Reckoner Rates in Maharashtra

In a recent notification released by the revenue department's Mumbai office, it has been stated that the Maharashtra government has decided to maintain the existing govt. ready reckoner rates for the financial year 2023-24. This decision has brought considerable relief to homebuyers, as the government had previously decided to keep the rates unchanged in May 2020 due to the impact of the Covid-19 pandemic. The ready reckoner rates were last raised in the year 2020-21, with an increment of 1.74%.

The revised rate hikes as per the Maharashtra Government have been tabulated here [Updated March 2023]:

| Areas | RR rate (%hike) |

|---|---|

| Panvel | 9% |

| Pune | 0.0612 |

| Pimpri Chinchwad | 0.1236 |

| Sholapur | 0.0808 |

| Nasik | 12.15% |

| Ahmadnagar | 7.72% |

| Latur | 0.1193 |

| Aurangabad | 0.1238 |

| Thane | 9.48% |

| Navi Mumbai | 8.90% |

| Ulas Nagar | 9.81% |

| Vasai-Virar | 9.00% |

Premium Charged Based on the Floor

In Maharashtra, a premium is charged for properties located on higher floors. The premium charged depends on the number of floors above the ground level. About 20% premium amount is charged depending on the floor levels in the areas of Navi Mumbai, Nashik, Pune and Mumbai.

The table below highlights the ready reckoner rates premium charges based on the number of floors:

| Floor Levels | Premium Charged (in %) |

|---|---|

| Up to 4th Floor | Nil |

| 5th to 10th Floor | 5 |

| 11th to 20th Floor | 10 |

| 21st to 30th Floor | 15 |

| 31st Floor and above | 20 |

Location-Wise Ready Reckoner Rate in Mumbai and Pune

The Ready Reckoner Rate in Mumbai and Pune varies depending on the location of the property. Here are the Ready Reckoner Rates for 10 locations in Mumbai and 5 locations in Pune: Ready Reckoner Rates for Mumbai Region:

| Area | Residential (per sq. m.) | Industrial (per sq. m.) |

|---|---|---|

| Andheri East | Rs 1.14 Lakhs - Rs 2.44 Lakhs | Rs 1.25 Lakhs - Rs 2.68 Lakhs |

| Andheri East Kurla Road | Rs 1.08 Lakhs - Rs 1.58 Lakhs | Rs 1.43 Lakhs - Rs 1.74 Lakhs |

| Ghansoli | Rs 76300 | Rs 91500 |

| Andheri Oshiwara | Rs 1.01 Lakhs - Rs 2.37 Lakhs | Rs 1.21 Lakhs - Rs 2.61 Lakhs |

| Vashi | Rs 103000 | Rs 120200 |

| Kalyan | Rs 69100 | Rs 77700 |

| Thane | Rs 83800 | Rs 105200 |

| Bandra East | Rs 1.11 Lakhs - Rs 2.90 Lakhs | Rs 1.30 Lakhs - Rs 3.27 Lakhs |

| Airoli | Rs 80300 | Rs 85700 |

| Kopar Khairne | Rs 87700 | Rs 101900 |

Ready Reckoner Rates for Pune Region

| Area | Residential (per sq. m.) | Industrial (per sq. m.) |

|---|---|---|

| Akrudi | Rs 42,230 - Rs 57,480 | Rs 45,470 - Rs 72,890 |

| Khadaki Cantonment | Rs 37,120 - Rs 44,870 | Rs 39,570 - Rs 53,500 |

| Kondhwa Budruk | Rs 40,360 - Rs 56,250 | Rs 43,050 - Rs 61,910 |

| Lohegaon | Rs 36,040 - Rs 75,420 | Rs 40,950 - Rs 96,650 |

| Bhosari Vibhag | Rs 40,770 - Rs 52,090 | Rs 43,380 - Rs 53,030 |

How to Find Ready Reckoner Rates in Maharashtra?

There are several ways to find the Ready Reckoner Rate in Maharashtra. One of the easiest ways is to visit the official website of the Inspector General of Registration (IGR). The IGR Ready Reckoner Rate Maharashtra website provides detailed information on the Ready Reckoner Rates for all areas in the state. You can select your district, sub-district, and village to get the Ready Reckoner Rate for that particular area.

Another way to find the Ready Reckoner Rate is to check the website of the Maharashtra government. The website provides all the latest information on the Ready Reckoner Rates, including any changes made by the government. Additionally, many real estate websites also provide information on the Ready Reckoner Rates for various areas in Maharashtra.

Conclusion

The Ready Reckoner Rate in Maharashtra is an important factor in the real estate market. It is used to calculate the stamp duty and registration charges that need to be paid when buying or selling a property. The rate is determined by the government and is revised every year based on various factors such as location, infrastructure, and market conditions.

It is important for buyers, sellers, and real estate professionals to understand how the rate is calculated and how it affects the overall cost of buying or selling a property. By staying up-to-date with the latest Ready Reckoner Rates, individuals can make informed decisions about their real estate transactions in Maharashtra.

If you wish to sell your property in an easy and convenient fashion, then we at PropReturns have just the solution for you. Simply list your property and get quality purchase requests. We also facilitate the purchase of commercial real estate, making the whole process simple and quick.