Real estate has always been a popular investment choice in India, with the potential to provide excellent returns over time. However, it's not a decision to be taken lightly. As with any investment, there are risks and rewards, and it's important to understand the market before investing your hard-earned money. For example, did you know that the real estate market in India is highly localized? What works in one city might not work in another. The prices, demand, and supply of properties vary widely depending on the location. So, it's essential to research the market thoroughly to make an informed decision.

This article will help you get guided with the real estate market in India, why and how to invest in real estate markets, along with some investment tips.

Overview of the Real Estate Market in India

According to a report by the Indian Brand Equity Foundation (IBEF), the Indian real estate market is expected to reach USD 1 trillion by 2030. The sector contributes 7% to India's GDP and is one of the largest employers in the country, with over 50 million people employed directly or indirectly. The demand for housing and commercial space has been on the rise due to the growing population, urbanization, and increased investment in infrastructure.

Why Invest in Real Estate?

There are many benefits to investing in Indian real estate.

Security: It offers a sense of security because it is a property item. The value of the property fluctuates less than other assets like stocks and mutual funds and is unaffected by market volatility.

Consistent Rental Yield: Investing in real estate generates consistent rental revenue, which can serve as a reliable source of passive income. Since property values tend to rise over time, real estate investing also has the potential for capital appreciation.

Government Policies: Moreover, the Indian government has introduced several favorable policies to boost the real estate sector, such as the implementation of the Real Estate (Regulation and Development) Act, 2016 (RERA), which has brought transparency and accountability to the real estate industry.

High Demand: Also, real estate is a sector that has a never-ending demand. India's rising middle class and increasing urbanization are driving the demand for residential and commercial properties. As more people migrate to cities for better opportunities, the demand for housing and commercial spaces is expected to grow.

These are some of the strong reasons why you should invest in Real estate in India.

How to Invest in Real Estate in India?

Investing in real estate can be a great way to diversify your portfolio and potentially earn attractive returns. Here's a step-by-step guide on how to invest in real estate in India:

Determine your investment goals: The first step is to determine your investment goals. Are you looking for a long-term investment that will provide steady rental income, or are you looking for a short-term investment that you can flip for a quick profit? Understanding your investment goals will help you identify the best investment opportunities.

Research the real estate market: Before investing in real estate, it's important to research the market. Look at current property prices, rental rates, and vacancy rates in the area where you are interested in investing. This will help you identify areas with strong potential for growth.

Identify investment opportunities: Once you have a good understanding of the real estate market, it's time to start looking for investment opportunities. You can search for properties online or work with a real estate agent who specializes in investment properties.

Inspect and review: Before making any investment, inspecting the property, reviewing financial statements, and analyzing market trends are important. You may also want to consult with a real estate attorney or financial advisor to ensure that the investment meets your goals and is structured in a way that minimizes your risk.

Secure financing: If you need financing to purchase the property, you will need to secure a loan. You can work with a bank or other financial institution, or consider alternative financing options such as hard money loans.

Close the deal: Once you have completed your due diligence and secured financing, it's time to close the deal. This involves signing the necessary paperwork and transferring ownership of the property.

Manage the investment: If you are purchasing a rental property, you will need to manage the investment. This includes finding tenants, collecting rent, and maintaining the property.

Investing in real estate can be a complex process, but by following these steps and working with experienced professionals, you can minimize your risk and potentially earn attractive returns on your investment.

Where Can You Invest Without Buying A Property?

There are several ways where you can invest without buying actual property in physical forms. Here are some such ways:

Real Estate Investment Trusts (REITs)

REITs are investment funds that own and manage income-generating real estate assets. A Real Estate Investment Trust (REIT) is kind of like a piggy bank, but instead of holding your money, it holds properties like buildings, offices, and apartments.

When you invest in a REIT, you're essentially putting your money into a pool with lots of other people. Together, all of you own a share of the properties that the REIT holds. And just like a piggy bank, your investment can grow over time as the value of the properties increases.

The history of REITs (Real Estate Investment Trusts) can be traced back to the 1960s in the United States when Congress passed the REIT Act in 1960, which created a new tax structure for real estate investment. This allowed for the formation of the first REIT in 1961, which was known as the American Realty Trust.

Over the years, REITs gained popularity and became an increasingly popular investment vehicle. If you want to invest in REITs, check out our offerings.

Real Estate Wholesaling

If you want to start investing without a huge initial amount, then you can choose to do Real estate wholesaling. Real estate wholesaling is a strategy in which an investor, generally called a wholesaler finds and contracts to buy a property, and then assigns the contract to another investor (called a buyer) for a fee. The buyer then closes on the property, and the wholesaler collects their fee.

The history of real estate wholesaling is not clear, but it is believed to have been around for several decades. It has gained popularity in recent years due to the rise of real estate investing and the ease of finding properties through online listing platforms and other resources.

Real estate wholesaling can be a great way for new investors to get started in real estate investing, as it requires little to no money down and can be done with minimal risk.

Real Estate Mutual Funds

Real estate mutual funds can be a great way for investors to test the waters of the real estate market without having to deal with the hassle of owning and managing physical properties. Real estate mutual funds are investment funds that invest primarily in real estate-related assets such as REITs, real estate stocks, and other real estate-related securities.

The history of real estate mutual funds dates back to the 1970s when the first real estate mutual fund was launched in the United States.

There are several different types of real estate mutual funds, each with its own unique investment objectives and strategies. Some of the most common types of real estate mutual funds are Equity REITs Funds, Mortgage REITs Funds, Real Estate Sector Funds, etc.

Online Real Estate Investment Platforms

It is a relatively new concept that has rapidly gained popularity among investors looking for a way to invest in real estate without actually owning physical property. These platforms allow investors to pool their money together to invest in real estate projects, providing a convenient and accessible way to gain exposure to the real estate market.

One of the main advantages of online real estate investment platforms is the ability to invest in real estate without the hassle of owning and managing physical properties. This is particularly attractive for investors who are looking for a passive investment opportunity that allows them to diversify their portfolio without having to deal with the complexities and risks associated with owning physical properties. PropReturns offers a range of commercial and fractional properties that you can invest in. Explore here.

Hard Money Loans

When it comes to buying or investing in real estate, one common financing option is a hard money loan. Simply put, a hard money loan is a type of short-term loan that is typically used in real estate transactions. Unlike traditional loans that are issued by banks or other financial institutions, hard money loans are provided by private lenders who are willing to take on a higher level of risk in exchange for potentially higher returns.

Tips Before Investing in Real Estate

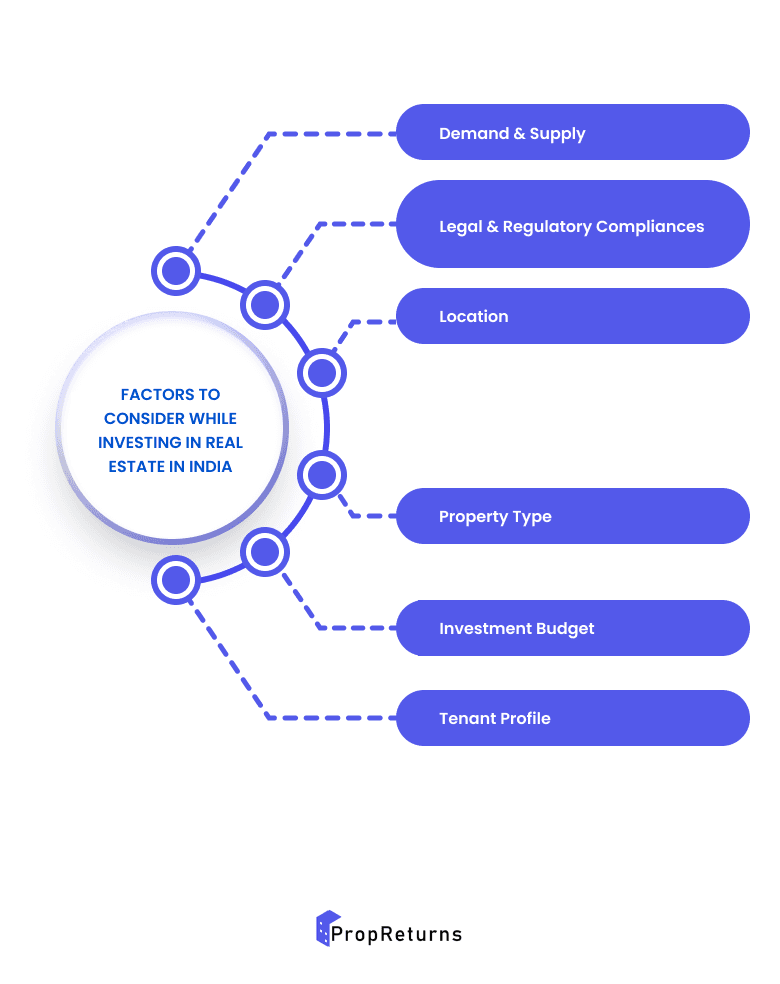

Before investing in real estate in India, it is important to consider several factors to ensure a profitable and secure investment. Here are some tips to keep in mind:

Location: Location is a crucial factor that can significantly affect the value of the property. Choose a location that has good connectivity, infrastructure, and amenities. Areas that are expected to see future development and growth may also be good investment options.

Budget: Set a budget and stick to it. Consider all the costs involved, such as stamp duty, registration fees, and maintenance charges.

Legal Due Diligence: Ensure that all the necessary legal documents are in place, such as the title deed, building plan, and occupancy certificate. It is important to verify the authenticity of the documents and conduct a thorough legal due diligence to avoid any legal complications in the future.

Investment Strategy: Decide the investment strategy that suits your investment goals and risk appetite. Consider various investment options, such as direct investment, commercial property, REITs, fractional investment, and mutual funds.

Is Real Estate a Good Investment in India?

The best way to invest in real estate in India depends on the individual's investment goals and risk ratios. Some popular investment options are direct investment, commercial property, REITs, fractional investment, and mutual funds. Property investment in India provides a sense of security, steady rental income, and potential for capital appreciation, but it also comes with its own set of challenges.

The minimum amount to invest in real estate in India depends on the investment option. Direct investment can require significant capital, while REITs and fractional investments can be made with as little as Rs. 10,000. However, comparing real estate investment and stock markets do matter. Both real estate and stocks have their advantages and disadvantages. Real estate offers stability and diversification, while stocks offer liquidity and the potential for higher returns.

Conclusion

Real estate investment in India can be a lucrative opportunity, but it's not something to jump into without careful consideration. By doing your research and understanding the market and legal framework, you can make an informed decision and potentially reap the rewards of this investment. Compared to other assets like stocks, real estate investment provides stability and diversification, making it a viable investment option for investors with a long-term investment horizon.

Whether you are looking to invest in commercial property, fractional real estate or REITs, PropReturns is the one-stop solution to check out. Here are our listings.