Jeevan is a retired astronaut who recently returned from a decade-long mission exploring the outer reaches of our solar system. After traveling millions of miles through space, Jeevan has decided to sell his luxurious bunglow in Mumbai.

As Jeevan prepares to put his property on the market, he's been doing some research and has come across the term "TDS." Curious to learn more about it, he has been diving deep into the world of real estate taxes and regulations.

Despite his extensive experience as an astronaut, Jeevan quickly realizes that the world of real estate can be just as complex and vast as the universe he explored. But with his adventurous spirit and thirst for knowledge, he is determined to navigate this new frontier and successfully sell his property while staying compliant with all applicable laws and regulations. In this article, we will summarise all that Jeevan learnt about the payment of TDS on the sale of property.

What is TDS on Sale of Property?

TDS stands for Tax Deducted at Source and is a type of tax that is deducted by the buyer of the property at the time of payment to the seller. If the property is valued at more than Rs. 50 lakh, the buyer must pay TDS at a rate of 1% of the sale consideration. In order to claim the TDS amount as a refund, the seller must submit an income tax return.

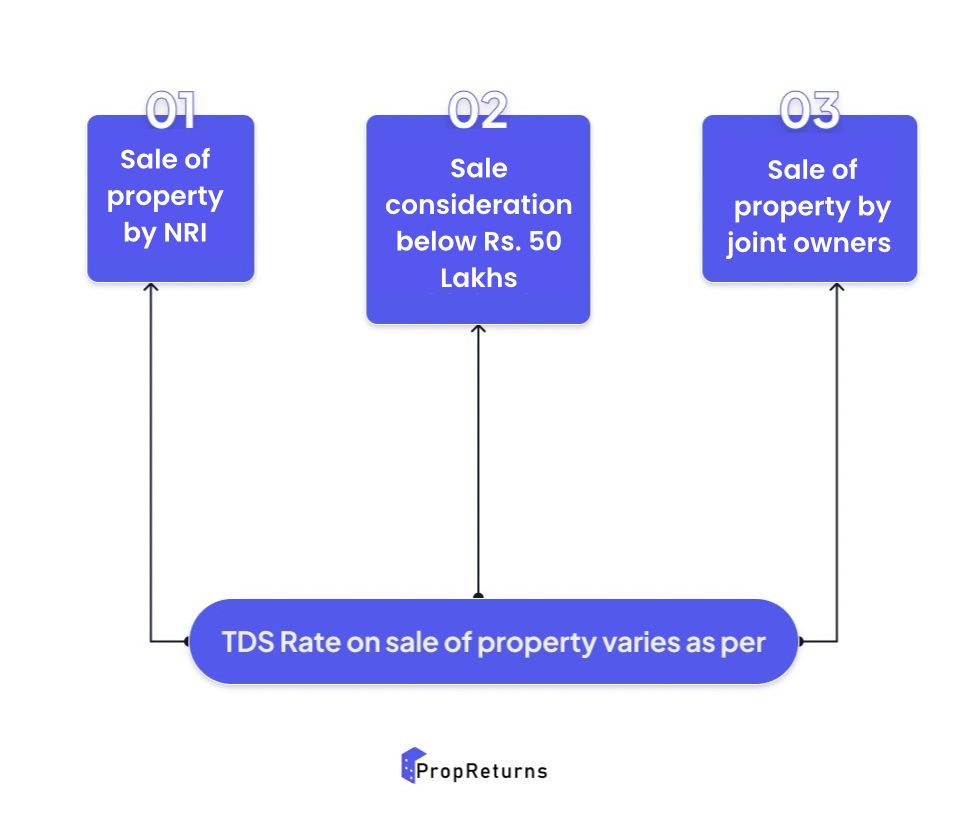

TDS Rate on sale of property

The TDS rate on the sale of the property is 1% of the sale consideration. However, this rate may vary for certain types of sellers or in certain circumstances. Here are some scenarios where the TDS rate on the sale of property may differ:

TDS on Sale of property by NRI: If the seller is an NRI (non-resident Indian), the TDS rate on the sale of a property is generally 20% of the sale consideration. However, if the NRI has obtained a lower deduction certificate from the Income Tax Department, the TDS rate may be lower.

TDS on Sale of property by joint owners: If the property is jointly owned by multiple sellers, the TDS rate will be calculated based on the percentage of ownership of each seller. For example, if there are two sellers and one has 60% ownership of the property and the other has 40% ownership, the TDS rate for the first seller will be 0.6% (60% of 1%), and for the second seller, it will be 0.4% (40% of 1%).

Sale consideration is below Rs. 50 lakhs: If the sale consideration of the property is below Rs. 50 lakhs, then there is no TDS required to be deducted.

It is important to note that the TDS on the sale of the property should be deducted at the time of payment or at the time of credit of the consideration, whichever is earlier. If the TDS is not deducted or deducted at a lower rate, it can lead to penalties and legal consequences. Therefore, it is advisable to consult a tax expert or chartered accountant to ensure compliance with the TDS rules.

TDS on sale of property in case with Joint Sellers##

In case the property is owned jointly by more than one seller, the TDS is deducted proportionately from the amount paid to each seller. For example, if the property is owned jointly by two sellers and the sale consideration is Rs. 1 crore, the TDS will be deducted at the rate of 1% from Rs. 50 lakh paid to each seller.

TDS on sale of property by NRI

If the seller is an NRI, the TDS rate is different from that applicable to resident Indians. The TDS rate in the case of NRIs is 20% of the sale consideration. However, if the NRI has taxable income in India, they can claim a refund of the excess TDS deducted by filing an income tax return.

| Capital gains for NRI | TDS rate |

|---|---|

| Long-term capital amount(property sale after 2 years of purchase) | 20% |

| Short-term capital amount(property sale within 2 years of purchase) | According to the tax slab of the NRI individual. |

How to make Payment of TDS on sale of property?

For TDS on sale of property, online payment, follow these steps:

Visit the official website of the Income Tax Department of India at https://www.incometaxindia.gov.in/

Click on the "Login" button and enter your credentials to log in to your account. If you do not have an account, you will need to register first.

After logging in, click on the "e-Pay Taxes" section.

Select the appropriate challan for TDS payment. For TDS on the sale of property, you need to select challan ITNS 281.

Fill in the required details in the challan, such as the type of payment, assessment year, and other details related to the property transaction, such as the PAN of the seller and buyer, property details, etc.

Select the mode of payment. You can choose to pay online using Internet banking, a credit/debit card, or through a bank branch.

Once you have selected the mode of payment, you will be redirected to the payment gateway. Follow the instructions provided on the screen to complete the payment.

After successful payment, you will receive a challan counterfoil or an acknowledgment receipt with a unique Challan Identification Number (CIN).

Save the TDS on the sale of the property challan receipt for your records, as it serves as proof of payment.

By following these steps, you can make payment of TDS on the sale of property and avoid any legal consequences or penalties. It is important to note that the TDS joint sellers' payment and return filing process may differ for NRI sellers and joint sellers. Therefore, it is advisable to consult a tax expert or chartered accountant for guidance.

What Happens if you miss Paying TDS?

If the TDS on the sale of the property is not paid or is paid late, the buyer may face penalties and interest charges. The seller may also face difficulties in claiming the TDS amount as a refund. Therefore, it is essential to make the payment of TDS on time to avoid any legal or financial implications.

Conclusion

TDS on the sale of the property is an important aspect of selling a property. It is majorly the responsibility of the purchaser to deduct and deposit TDS on behalf of the seller. In the case of joint sellers and NRI sellers, the TDS rate is different from that applicable to resident Indian sellers. The payment of TDS can be made through both offline and online modes, and failing to pay TDS can result in penalties and loss of benefits for both parties. Just like Jeevan, you now know all about TDS and how to make the payment. Happy selling!