Investing in real estate has always been considered a lucrative investment option, but the challenges of managing properties can be daunting for many investors. However, with the introduction of Real Estate Investment Trusts (REITs) in India, investing in the real estate sector has become much simpler and more accessible for retail investors.

The world of real estate investment trusts or REITs is full of opportunities. The global REIT industry has grown significantly over the past few decades, with total market capitalization reaching over $1.9 trillion in 2022.

If you're looking for a unique way to diversify your investment portfolio while also potentially earning a steady stream of income, then REITs may be just what you're looking for. These investment vehicles allow you to invest in real estate without actually having to own property yourself, giving you the opportunity to reap the rewards of the real estate market without the hassle of being a landlord.

What are REITs?

Real Estate Investment Trust in India (or REIT in India) are investment vehicles that own and operate income-generating real estate properties such as office buildings, residential apartments, shopping malls, hotels, and warehouses. REITs work by pooling money from multiple investors and using it to purchase a diversified portfolio of real estate assets.

The income generated from these assets is then distributed to the investors in the form of dividends. REITs are regulated investment vehicles and offer investors an opportunity to invest in the real estate sector without directly owning or managing the properties.

In India, REITs were introduced by the Securities and Exchange Board of India (SEBI) in 2014 to provide investors with a transparent and regulated investment option in the real estate sector.

So, where did REITs come from?

REITs first originated in the United States in the 1960s and have since expanded globally, with various countries adopting their own versions of REITs.

The history of REITs in the world can be traced back to 1960 when the US Congress passed legislation that allowed for the creation of REITs as a way to provide a tax-efficient mechanism for real estate investment.

REITs were introduced in India on 2014 after SEBI issued guidelines for the formation and listing of REITs. The first REIT in India, known as Embassy Office Parks REIT, was listed on the Bombay Stock Exchange in 2019. Currently, India has a few listed REITs that have helped in providing an alternative investment option for investors looking to diversify their portfolios.

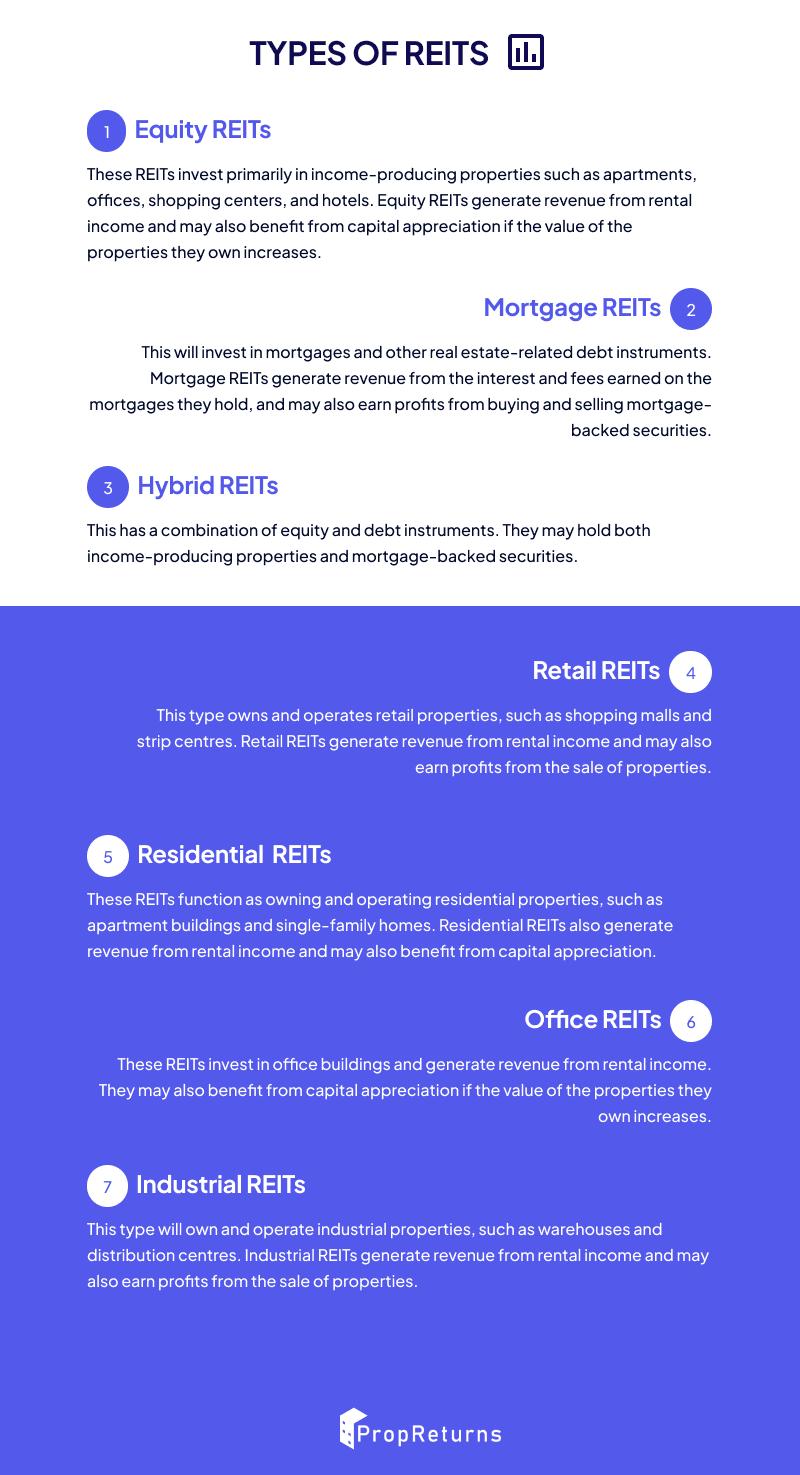

What are the types of REITs in the market?

To make it easy for the investors the REITs are characterised into different types. The most common and unique types for your clear understanding are:

Equity REITs: These REITs invest primarily in income-producing properties such as apartments, offices, shopping centres, and hotels. Equity REITs generate revenue from rental income and may also benefit from capital appreciation if the value of the properties they own increases. An example is India’s first publicly-listed REIT, Embassy Office Parks REIT. It has a portfolio of office parks and city-centre office buildings, and is listed on the Bombay Stock Exchange. Another example is the Mindspace Business Park REIT.

Mortgage REITs: This will invest in mortgages and other real estate-related debt instruments. Mortgage REITs generate revenue from the interest and fees earned on the mortgages they hold, and may also earn profits from buying and selling mortgage-backed securities. As of now, there are no mortgage REITs in India, but they could very well make an entry into the market in the next couple of years.

Hybrid REITs: This has a combination of equity and debt instruments. They may hold both income-producing properties and mortgage-backed securities.

Retail REITs: This type owns and operates retail properties, such as shopping malls and strip centres. Retail REITs generate revenue from rental income and may also earn profits from the sale of properties.

Residential REITs: These REITs function as owning and operating residential properties, such as apartment buildings and single-family homes. Residential REITs also generate revenue from rental income and may also benefit from capital appreciation.

Office REITs: These REITs invest in office buildings and generate revenue from rental income. They may also benefit from capital appreciation if the value of the properties they own increases. In India, Brookfield India REIT, operated by Brookfield AMC is an office REIT with commercial properties in Mumbai, Gurugram, Noida and Kolkata.

Industrial REITs: This type will own and operate industrial properties, such as warehouses and distribution centres. Industrial REITs generate revenue from rental income and may also earn profits from the sale of properties.

Which Company Qualifies as a REIT?

In order to qualify as a REIT, a company must meet certain requirements which include:

The company must invest at least 80% of its total assets that generate revenue.

Only 10% of the total investment must be made in real estate under-construction properties

The company must have to distribute at least a minimum requirement of 90% of its taxable income to the shareholders each year in the form of dividends

The company must have an asset base of at least Rs 500 crores

NAVs must be updated twice in every financial year

In addition to meeting these requirements, a company must also have a diverse shareholder base and a management structure that allows for effective oversight and control.

As of 2023, there are three REITs available in India:

- Embassy Office Parks REIT

- Mindspace Business Park REIT

- Brookfield India REIT

How do REITs work?

The Real Estate Investment Trusts work by allowing investors to pool their money together to invest in a portfolio of real estate properties. The mode of operation is quite simple and clear as follows,

A REIT company purchases or develops income-generating properties such as office buildings, shopping malls, apartments, and hotels

Investors can buy shares of the REIT company, which represents a portion of ownership in the portfolio of properties

The REIT company generates revenue from rental income, lease agreements, or property sales

The profits from these activities are distributed to investors as dividends, typically on a quarterly basis

Investors can choose to reinvest their dividends to purchase additional shares of the REIT, or they can receive cash payouts

The value of the shares may fluctuate based on the performance of the underlying properties and the overall real estate market

REITs also provide liquidity, meaning that investors can buy and sell shares on public stock exchanges. Overall, REITs offer a convenient way for investors to invest in real estate with diversification and potentially higher returns compared to traditional stocks and bonds.

If you want to read more about REITs, you can find our blog on All About REITs in India.

How to Invest in REITs in India?

Curious about how to buy REITs in India? Investing in REITs is easy and can be done through a variety of channels as follows:

1) Through a stockbroker:

- REITs trade on stock exchanges like other securities, and investors can buy and sell REIT units through their stockbrokers.

2) Through a mutual fund:

- Some mutual funds invest in REITs, and investors can invest in these funds to gain exposure to real estate.

3) Through a direct investment:

- Investors can directly invest in a REIT by purchasing units through the primary market when the REIT offers its units for sale.

Expected returns from REITs

The expected returns from REITs, or Real Estate Investment Trusts, can vary based on several factors, including the underlying real estate properties, the overall real estate market, and the management of the REIT. However, historically, REITs have offered attractive returns compared to other asset classes, such as stocks and bonds.

You can calculate approximate REIT returns using our REIT Calculator.

According to the National Association of Real Estate Investment Trusts (NAREIT), the total return of the FTSE NAREIT All Equity REITs Index was 18.31% in 2021, including both price appreciation and dividends. Over the past 20 years, the index has had an average annual total return of 10.22%.

Past performance is not a guarantee of future results and that the returns from REITs can vary based on many factors. Different types of REITs, such as those focused on residential, commercial, or industrial properties, may offer different returns based on the performance of those property types and the local real estate markets.

Advantages and Limitations of REITs

Advantages:

- Diversification:

REITs allow investors to diversify their portfolios by investing in a variety of real estate properties across different geographic locations and property types.

High Dividend Yield: REITs are required by law to distribute at least 90% of their taxable income to shareholders as dividends, which can provide a reliable source of income for investors.

Liquidity: REITs trade on stock exchanges, making them easy to buy and sell like stocks.

Professional Management: These are managed by professional teams who are experienced in managing real estate properties, which can provide better returns for investors.

Tax Benefits: REITs are not taxed at the corporate level if they distribute at least 90% of their taxable income to shareholders. This means that investors may be able to avoid double taxation on their investments.

Limitations:

Market Risk: The value of REITs can fluctuate based on changes in the real estate market and other economic factors.

Interest Rate Sensitivity: REITs are sensitive to interest rate changes, and rising interest rates can reduce the value of REITs.

Limited Control: Investors in REITs have limited control over the management of the underlying properties and may not have a say in how the properties are operated.

Management Fees: REITs charge management fees, which can reduce the overall returns for investors.

Concentration Risk: Some REITs may be heavily invested in a particular geographic region or property type, which can increase the risk of the portfolio if there are issues in that region or type of property.

How are REITs Taxed in India?

In India, REITs( Real Estate Investment Trusts), are taxed based on the income earned from the rental or lease of the underlying properties. Let's see them,

Dividend Distribution Tax (DDT): REITs are required to distribute at least 90% of their taxable income to shareholders as dividends. These dividends are subject to a Dividend Distribution Tax (DDT) of 25% (plus applicable surcharge and cess), payable by investors.

Tax on Rental Income: The rental income earned by the REIT is taxed at the applicable income tax rate, which can range from 0% to 30% depending on the income level.

Capital Gains Tax: If the REIT sells a property, any capital gains realized from the sale are subject to tax at the applicable capital gains tax rate. The tax rate can vary depending on the holding period of the property and the type of gain (short-term or long-term).

Goods and Services Tax (GST): REITs are also subject to GST on the services provided by the manager of the REIT.

Should you Invest in REITs India?

Before investing in REITs in India, investors should carefully consider the risks and advantages of REITs and ensure that they align with their investment goals and risk tolerance. While REITs can offer potential for attractive returns, they are subject to market risks, interest rate risks, and other risks associated with real estate investments. Whether or not to invest in REITs depends on an individual's investment goals, risk tolerance, and overall financial situation.

Conclusion:

REITs can be a good option for investors who want to gain exposure to real estate without having to manage properties themselves. Investors interested in investing in REITs should carefully review the company's financial statements and management structure, as well as the risks associated with the particular properties and markets in which the REIT invests. It is also important to understand the tax implications of investing in a REIT, as they can have significant tax benefits but also require careful tax planning.