Being the top choice of savvy investors, India’s commercial real estate is expected to grow at a CAGR OF 13% between 2022-2027.

Besides, Indian real estate is expected to reach $1 billion by 2030, with commercial real estate being a major contributor supporting the growth of the sector. Investors in the real estate sector have always considered commercial property investment a rewarding investment choice, that gives high ROI, capital appreciation, and passive income opportunities.

In this piece, we will cover all about Indian Commercial Real Estate Investments. Let’s get started!

What is commercial property investment?

Commercial properties are the ones that are used for business / non-residential purposes or income generation (by selling / leasing). Any investment in such properties with the intention of generating a cash flow is called commercial investment.

There are several ways in which one can invest in commercial real estate. The upcoming section talks about the same.

What are the types of commercial property investments?

As a CRE investor, there are a wide range of CRE options for you to invest in. We have listed them below:

1) Office Buildings 2) Retail Buildings 3) Industrial Buildings 4) Multifamily Buildings 5) Hospitality Buildings 6) Mixed-Use Buildings 7) Medical Buildings

You may read more about these types in our blog: A Guide to Commercial Real Estate Meaning & Basics

Further, there are different ways to invest in commercial real estate in India. Here’s how can you invest in commercial real estate:

- Direct investment: You may buy a commercial property individually or as part of a group, manage the property

- Real Estate Investment Trusts (REITs): You may buy shares of a company that owns commercial properties, trade on stock exchanges, and earn income through dividends

- Real Estate Crowdfunding: You may pool money together with other investors, browse projects, invest in a property or portfolio, and access commercial real estate with smaller amounts of capital

- Private Equity Funds: You may pool capital from high-net-worth individuals or institutional investors, invest in larger commercial real estate projects, and have a minimum investment requirement

Before investing, research, consult with a financial advisor, and understand potential risks and rewards.

Why Choose Commercial Investment?

1. Inflation hedge- Commercial properties are resilient assets when it comes to inflation. This is because, during inflation, the prices of properties rise. Due to this, the property owner can benefit from rent hikes and value appreciation of the property.

2. Regular returns- Commercial properties, especially pre-leased commercial properties generate regular rental income through their existing tenants. Additionally, the tenants of these properties are on a long-term lease tenure period of approx 5-15 years. According to the leasing norms of commercial pre-leased properties, the tenant is not supposed to cancel the lease tenure in between. If he does so, he has levied a heavy penalty. Hence, one can enjoy monthly rental income for a long time period!

3. Intangible asset- Unlike stocks and bonds, whose value fluctuates every other day, commercial properties aren’t tangible. More often than not, commercial property investment steadily appreciates over a period of time and is immune to inflation. Hence it ensures consistent high returns and minimum chances of loss.

Is buying a commercial property a good investment?

Here are the pros and cons of investing in CRE to help you understand commercial property investing better.

Pros

1. Stable source of high rental income: The average commercial property rental yield in India ranges from 8-11% vs residential properties, which yield a rental income between 1-2%, i.e. 4 times lesser yield. Depending on the area, the earning potential for investment in CRE is much more.

2. Long-term commitments: Commercial properties are usually leased for 10 to 20 years, with the possibility of subsequent renewal. Moreover, lease agreements come with a clause of yearly appreciation of the rental value. So, the owner of the commercial property has an assurance of regular and consistent returns.

3. Professional deals: Commercial real estate tenants are generally businesses with professional track records. Dealing with corporate tenants is always hassle-free and generally, there is no need to chase them for rent.

4. No furnishing cost: One of the most attractive features of investing in commercial properties is zero furnishing cost of the property. If you hand over the property to corporate tenants, they furnish the property as per their own requirements and taste. This is because branding is essential in a commercial space. Also, corporate clients have their guidelines to set up a proper infrastructure at the property they occupy.

5. Appreciation value: As compared to other property types, CRE provides stellar appreciation over time. What’s more, if you invest in a premium commercial property through fractional ownership or REITs, it may provide higher returns with a much lower and pocket-friendly investment.

6. Free from market fluctuations: Income from traditional investment options tends to become positive or negative depending on fluctuations in the financial markets. On the other hand, investment in commercial real estate is not affected by the performance of any other source of investment, because it has no relation to any changes in the stock or bond markets.

7. Tangible asset: Real estate is considered a more physical and tangible asset because you can see it and touch it. Investors can visit a property to get more insights into its size, location, condition, appearance, and many other features that may play a key role in its earnings. Whereas, stocks, bonds, mutual funds, etc. may not look appealing to such investors, because you can’t see them.

Cons

1. High ticket size: Generally, commercial properties are valued at Rs. 25 to 30 cr, and the minimum investment in CRE is typically beyond the reach of a retail investor. However, with fractional ownership, now you can start investing with Rs. 30 Lacs onwards.

2. Complex asset management: CRE tenants are corporates and not individuals, which requires smooth end-to-end asset management. Retail investors usually lack professional expertise in managing complex commercial assets.

3. Difficult entry: Because of complex legalities, extensive research required, and limited market opportunities, investing in this type of asset can be challenging for a naive retail investor.

4. Selection of property: Finding the right property and geographical location needs due diligence and market knowledge. An individual investor may therefore find it extremely difficult to invest in commercial properties due to a lack of market knowledge and other resources.

Commercial Vs Retail Property: Which is better to invest?

For this, first let's compare commercial and residential properties as per the below parameters:

| Category | Commercial Property | Residential Property |

|---|---|---|

| Buying Process | As it’s a huge property, buying a CRE is a lengthy process and hence many formalities are involved | The process of buying a residential property is comparatively easier |

| Period of Lease | CREs are leased to tenants for a long period of time. These leases may range from 3-9 years or more, as businesses rarely want to shift their operations from one place to another in a short span | Residential properties are leased for a shorter span of time, as here individuals/families may want to shift to another place within as less as 6 months due to a variety of reasons |

| Contract for Rent/Lease | CRE lease/rent contracts are in-depth and complex, as they are created for a long tenure | Residential property lease/rent contracts are comparatively simpler as they are created for short tenures |

| Rental Yield | Rental yield for a CRE may range from 8-11% of the capital invested | Rental yield for residential property may range from 1.5-3.5% of the capital invested |

| Income Stability | Due to the longer lease period, they generate regular rental income for owners for a long time period | As tenants shift to another place in short intervals, rental income for owners is less stable |

| Loan for Buying Property | A loan for buying a commercial property can be given to an individual or a business | A loan for buying a residential property can only be given to an individual |

| Leasing Process | The tenant and owner both are involved equally in the process of leasing | Residential legislation supports tenants over the owners, hence it is tough to evict the tenants |

Conclusion:

Even though certain factors like buying process and getting a loan are easier for residential property owners; the rental yield, income stability, and leasing process for CRE make it a preferred option for investment.

What type of commercial property is most profitable?

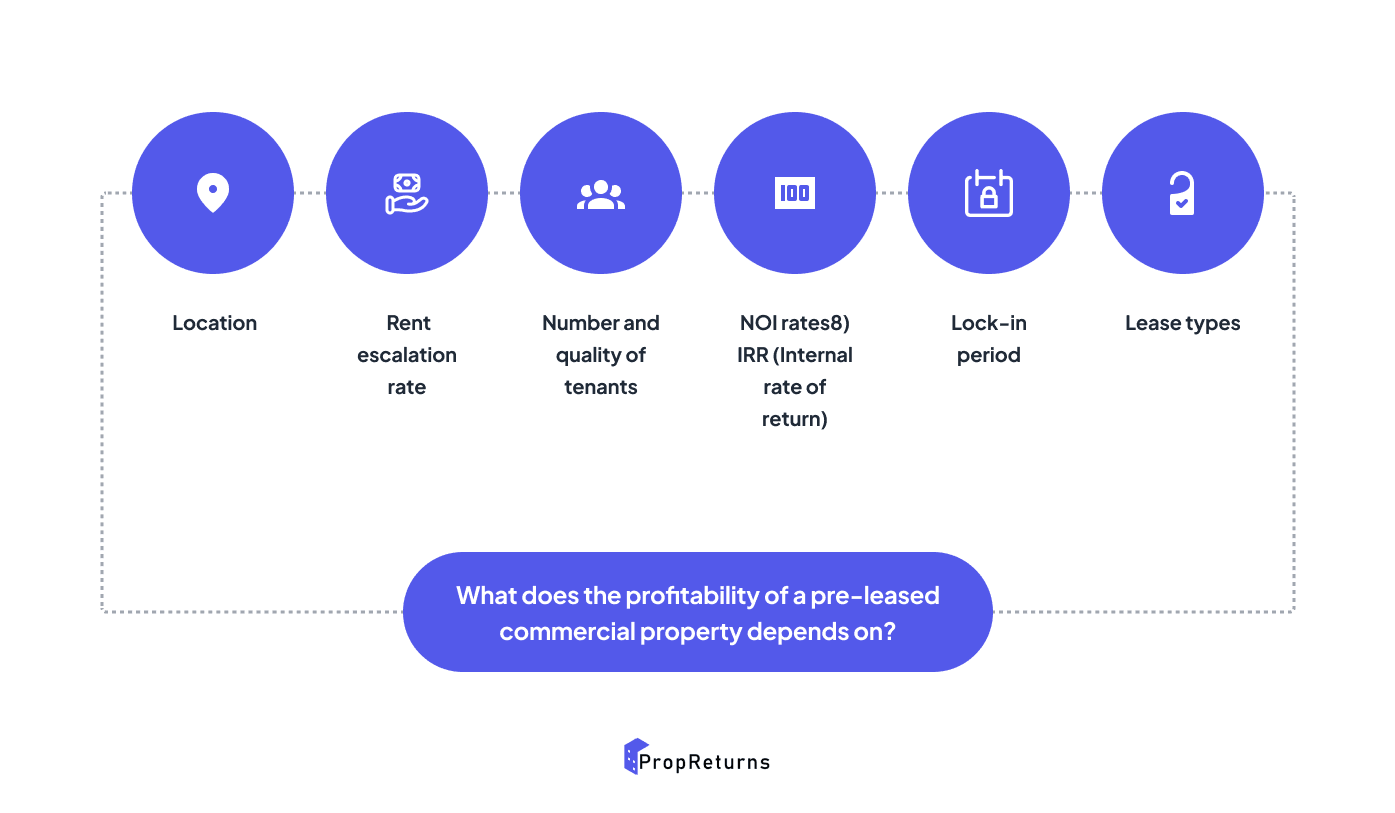

Anyone would want to invest in a property that gives good returns, isn’t it? These parameters will help you analyze a property before investing and make better-informed decisions

1) Properties located in prime locations- The location of a property is a crucial part of investing in a commercial property. Location decides the price of the property, its rent, ROI, IRR, appreciation/CAGR rate, and much more! Hence, choose a property situated in the investment hotspots of any area. Though the costs of such properties are much higher, you can surely cover the costs from future returns.

2) Total number of tenants and their quality- The more the occupancy rate of your property, the more the rental income you’ll earn. Also, the tenant quality matters a lot. Generally, the majority of the commercial properties are occupied by big MNCs and Fortune 500 companies. Hence, they maintain professionalism and pay regular rent too. Low-quality tenants possess the risk of delayed rental payments or skip rentals causing hassle. Hence tenant quality and occupancy are essential aspects.

3) Check for amenities and facilities- A commercial property with top amenities and facilities attracts good tenants. Having basic amenities like restaurants, hotels, parks, elevators, cafes, etc elevates the want of that particular property. A good commercial property is also one that is well-connected to transportation. This eases daily commutes and your property becomes a convenient option for prospective buyers/tenants.

4) Triple net lease- Triple net leases are those wherein tenants agree to pay the property insurance, property tax, and maintenance charges, in addition, to rent and utilities. Triple net leases tend to have lower rents because the tenant assumes ongoing expenses that would otherwise be the responsibility of the property owner. Triple net leased properties have become popular investment vehicles for investors because they provide low-risk, steady income.

5) Lock-in period: The lock-in period is the time/duration a tenant will be occupying the premise. The long-term lock-in period ensures extended stable rental income. In cases where the tenant exits the property before the lease term, he/she has to either pay the penalty or give away the security deposit to the owner, as mentioned above.

6) Rent escalation: The escalation of rent refers to the periodic appreciation of the rental income. For instance, a tenant can ask for an escalation of 5% every year, or 15% every 3 years based on the negotiation. The higher the tenant agrees upon rent escalation, the more rental yield you get.

7) Higher NOI rates: NOI helps real estate investors determine the capitalization rate, which in turn helps them calculate a property's value, thus allowing them to compare different properties they may be considering buying or selling. The higher the NOI, the better for the investor. NOI, (Net Operating Income) is a calculation used to analyze the profitability of income-generating real estate investments. NOI equals all revenue from the property, minus all reasonably necessary operating expenses.

8) Check for IRR (Internal rate of return): The Internal Rate of Return, is the annual rate of growth that an investment is expected to generate. If your selected property generates about 22% IRR, then you can consider investing in the property. However, just the IRR is not responsible for the returns your property generates. There are many other factors responsible to get desired returns.

Commercial Real Estate Investment Platform

PropReturns is a platform for users to invest in commercial property in India, backed by data. With us you can build wealth and earn passive income by investing in hand-picked investment Real Estate.

PropReturns offers an end to end solution for investors from placing an instant offer on a high ROI investment property to conducting the entire deal closure flow and paperwork through our platform.

View inaccessible financial metrics for Real Estate, now at your fingertips and save months of research!